Irs Calendar For Direct Deposit 2025 Calculator – The 529 savings plan allows any contributions to the account to grow tax-deferred. Money can be withdrawn tax-free as long as it’s used for qualified education expenses, such as . This form details how much interest was earned on government securities for the year—information that is also filed with the Internal Revenue Service (IRS). Interest from Treasury T-bill maturity .

Irs Calendar For Direct Deposit 2025 Calculator

Source : www.energy.gov

IRS Quarterly Payments 2024 Due Dates and How to Calculate

Source : ncblpc.org

3.30.123 Processing Timeliness: Cycles, Criteria and Critical

Source : www.irs.gov

Three IRS tax deadlines for June 17th

Source : vibes.okdiario.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

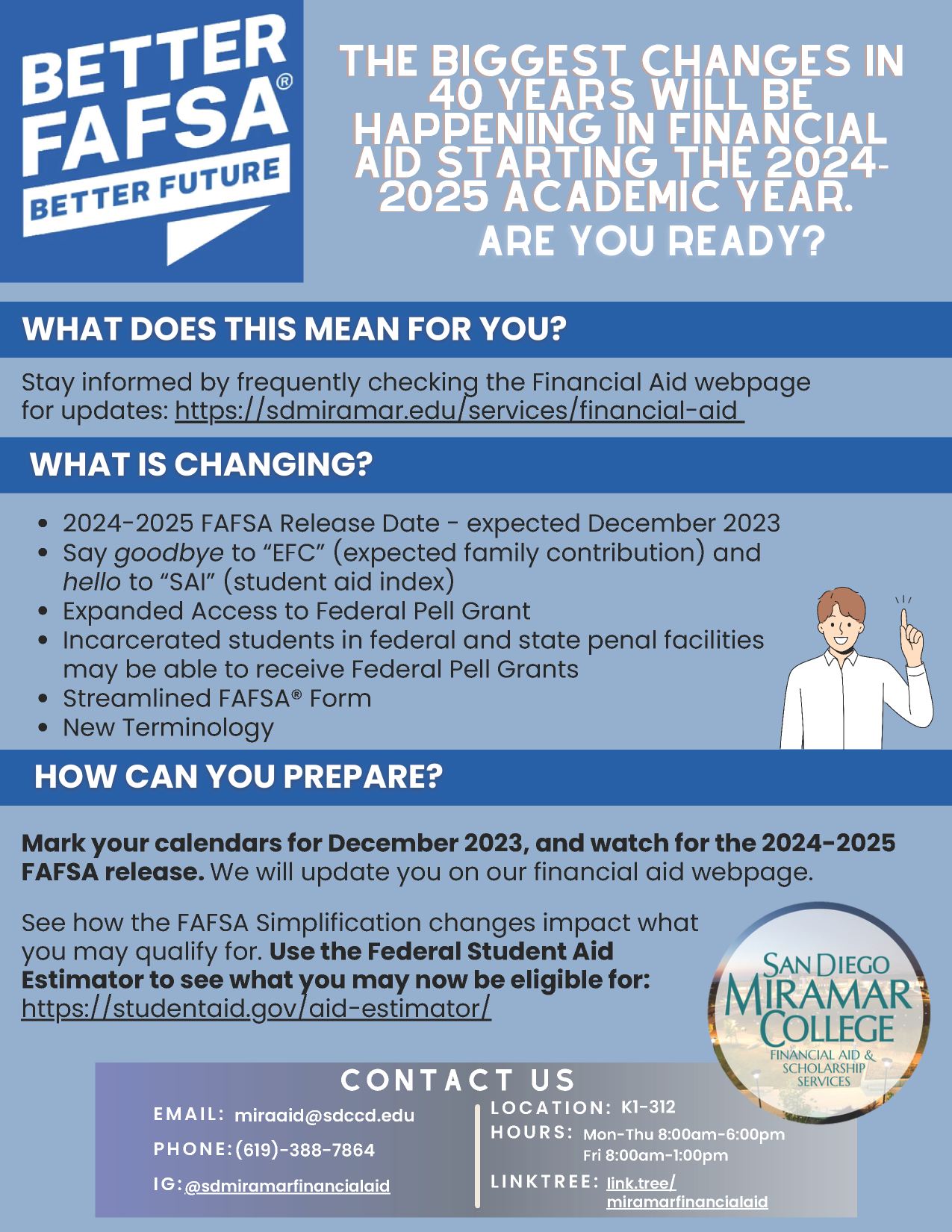

2024 25 FAFSA Simplification | San Diego Miramar College

Source : sdmiramar.edu

When Is Tax Day 2024? A Guide to When and How to File Buy Side

Source : www.wsj.com

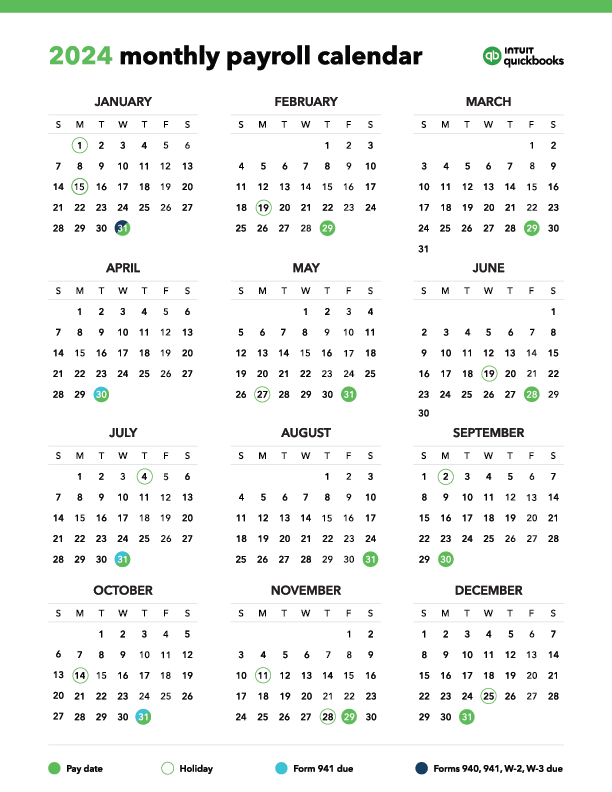

Payroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.com

Student Accounts Office | St. Francis College

Source : www.sfc.edu

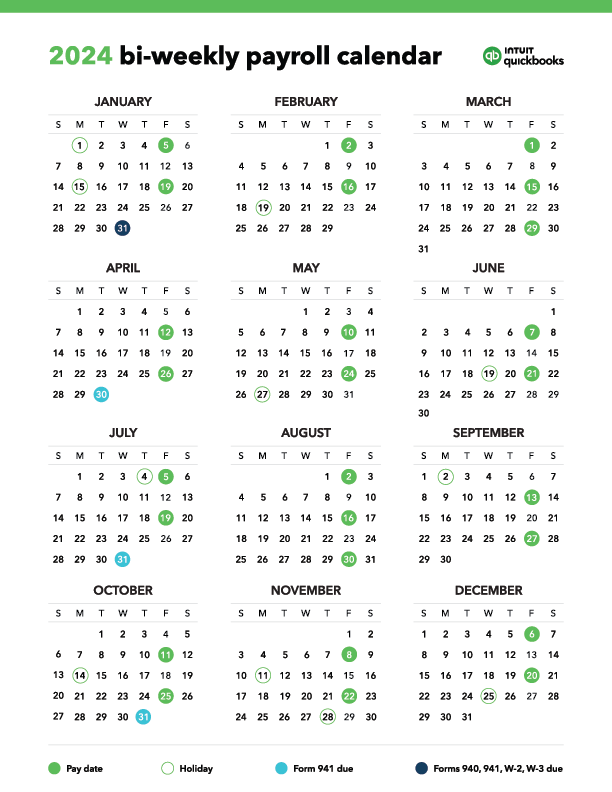

Payroll Calendar Templates 2024 2025 Biweekly & Monthly

Source : quickbooks.intuit.com

Irs Calendar For Direct Deposit 2025 Calculator Federal Solar Tax Credits for Businesses | Department of Energy: A reconciliation of the non-GAAP measure to the most directly comparable GAAP measures is included in our earnings release for the three and six months ended June 30, 2024, which is available on our . TEXT_4.